If all variable and fixed costs are covered by the selling price, the breakeven point is reached, and any remaining amount is profit. You may need to use the contribution margin formula for your company’s net income statements, net sales or net profit sheets, gross margin, cash flow, and other financial statements or financial ratios. Break even point (BEP) refers to the activity level at which total revenue equals total cost. Contribution margin is the variable expenses plus some part of fixed costs which is covered.

Ask Any Financial Question

- You work it out by dividing your contribution margin by the number of hours worked on any given machine.

- The contribution margin may also be expressed as fixed costs plus the amount of profit.

- A good contribution margin is one that will cover both variable and fixed costs, to at least reach the breakeven point.

- For instance, if you sell a product for $100 and the unit variable cost is $40, then using the formula, the unit contribution margin for your product is $60 ($100-$40).

Below is a breakdown of contribution margins in detail, including how to calculate them. Contribution margin analysis is a measure of operating leverage; it measures how growth in sales translates to growth in profits. Aside from the uses listed above, the contribution margin’s importance also lies in the fact that it is one of the building blocks of break-even analysis. With that all being said, it is quite obvious why it is worth learning the contribution margin formula. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

How to Use the Contribution Margin Ratio

Profit is gross margin minus the remaining expenses, aka net income. The CVP relationships of many organizations have become more complex recently because many labor-intensive jobs have been replaced by or supplemented with technology, changing both fixed and variable costs. For those organizations that are still labor-intensive, the labor costs tend to be variable costs, since at higher levels of activity there will be a demand for more labor usage. Similarly, we can then calculate the variable cost per unit by dividing the total variable costs by the number of products sold.

Contribution Margin Analysis Per Unit Example

Such fixed costs are not considered in the contribution margin calculations. The overall contribution margin is computed using total sales and service revenue minus total variable costs. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed selling and buying used restaurant equipment tips costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s. Since machine and software costs are often depreciated or amortized, these costs tend to be the same or fixed, no matter the level of activity within a given relevant range.

Would you prefer to work with a financial professional remotely or in-person?

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. As of Year 0, the first year of our projections, our hypothetical company has the following financials. One common misconception pertains to the difference between the CM and the gross margin (GM). In China, completely unmanned grocery stores have been created that use facial recognition for accessing the store. Patrons will shop, bag the purchased items, leave the store, and be billed based on what they put in their bags. Along with managing the purchasing process, inventory is maintained by sensors that let managers know when they need to restock an item.

Along with the company management, vigilant investors may keep a close eye on the contribution margin of a high-performing product relative to other products in order to assess the company’s dependence on its star performer. You can use a spreadsheet, such as Google Sheets or Microsoft Excel, to include columns by product, enabling you to compare the contribution margin for each of your business products. Should the product be viewed as more of a “loss leader” or a “marketing” expense? However, it may be best to avoid using a contribution margin by itself, particularly if you want to evaluate the financial health of your entire operation. Instead, consider using contribution margin as an element in a comprehensive financial analysis.

A negative contribution margin tends to indicate negative performance for a product or service, while a positive contribution margin indicates the inverse. You can also use contribution margin to tell you whether you have priced a product accurately relative to your profit goals. Fixed costs are one-time purchases for things like machinery, equipment or business real estate. If the company realizes a level of activity of more than 3,000 units, a profit will result; if less, a loss will be incurred. Here, we are calculating the contribution margin on a per-unit basis, but the same values would be obtained if we had used the total figures instead.

Gross profit margin is the difference between your sales revenue and the cost of goods sold. Fixed costs usually stay the same no matter how many units you create or sell. The fixed costs for a contribution margin equation become a smaller percentage of each unit’s cost as you make or sell more of those units.

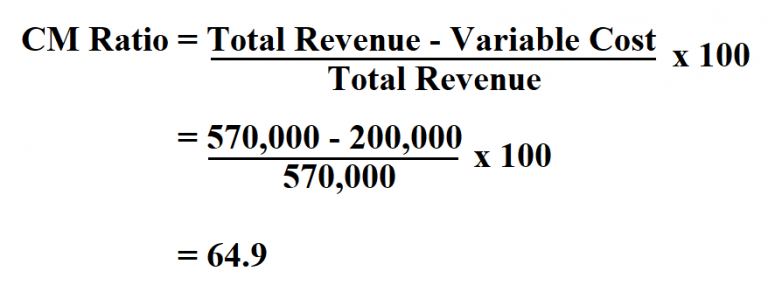

A business has a negative contribution margin when variable expenses are more than net sales revenue. If the contribution margin for a product is negative, management should make a decision to discontinue a product or keep selling the product for strategic reasons. The following formula shows how to calculate contribution margin ratio. The contribution margin ratio (CMR) expresses the contribution margin as a percentage of revenues. Alternatively, companies that rely on shipping and delivery companies that use driverless technology may be faced with an increase in transportation or shipping costs (variable costs).

It provides one way to show the profit potential of a particular product offered by a company and shows the portion of sales that helps to cover the company’s fixed costs. Any remaining revenue left after covering fixed costs is the profit generated. Yes, it means there is more money left over after paying variable costs for paying fixed costs and eventually contributing to profits. Cost accountants, FP&A analysts, and the company’s management team should use the contribution margin formula. CM is used to measure product profitability, set selling prices, decide whether to introduce a new product, discontinue selling a product, or accept potential customer orders with non-standard pricing.